Equity Execution

Sturdivant & Co. has offered equity agency-only execution services to its clients for over 33 years. Our mission remains the same, preserve alpha for our clients by minimizing transaction costs and information leakage. This is accomplished through our various execution strategies.

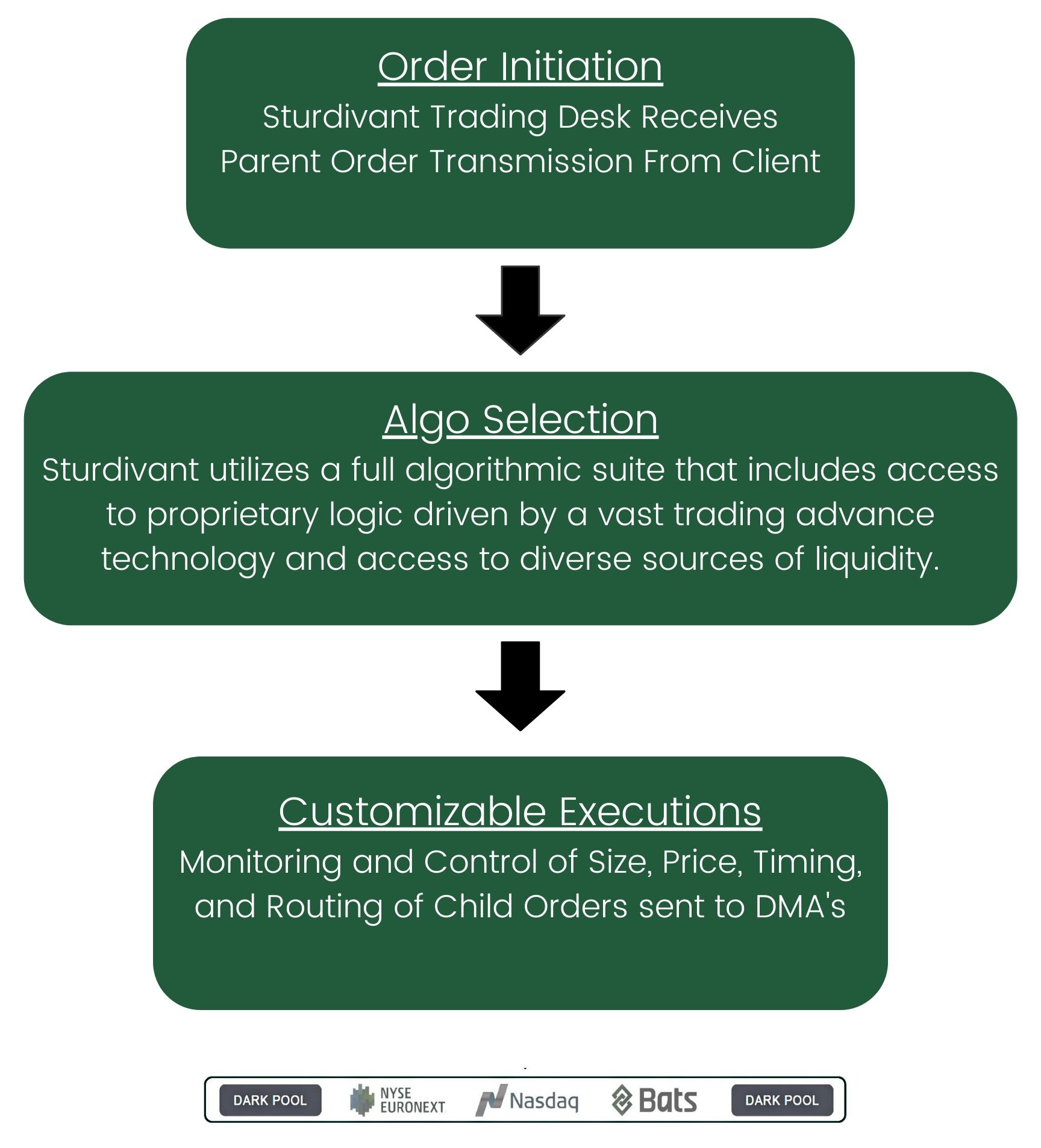

Sturdivant & Co.’s suite of electronic trading tools and technologies include sophisticated algorithms, advanced direct market access and smart order routing technology. With the combination of our many execution venues, Sturdivant has been successful in finding natural liquidity in the small and mid-cap space. Our high-touch model combined with our proprietary consumer equity research are our key differentiators to optimize performance for our clients. Sturdivant is fully FIX compatible and we have a long- standing, fully disclosed clearing arrangement that allows us to execute orders on all global exchanges with seamless connectivity to industry leading OMS, EMS and network providers.

Electronic\Algorithmic Trading

Equity Execution Services - Exclusive Algorithm Access

Sturdivant & Co. provides high-touch execution services on a leading-edge systematic trading platform combined with our proprietary consumer equity research. Utilizing various tools, we are able to determine and evaluate holdings as a percentage of daily volume and estimate the time needed to liquidate a specific holding or the portfolio as a whole. Our trade performance data is maximized – every action (whether a fill occurs or not) and recorded with millisecond level precision in the context of actual market conditions – insuring the highest-level of execution services.

High Touch Agency Trading

Sturdivant & Co. offers transition management services for plan sponsors, trustees, investment committees and other institutional investors who are making a change in their asset allocation or investment manager lineup. From overseeing the portfolio liquidation to participating in a multi-manager, multi-asset class reallocation, the primary goal is to help ensure that the investment objectives of the plan are maintained as assets are reallocated from one manager to another.

We utilize a variety of sophisticated trading strategies to enable clients to undertake a significant portfolio restructuring in the most cost-effective manner.

Transition Management